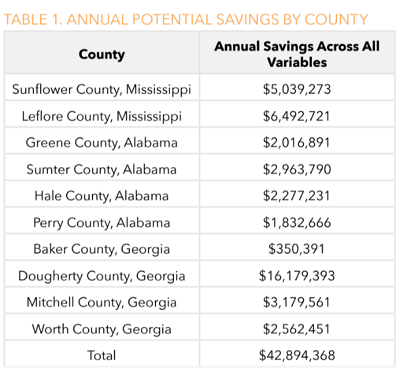

New Report: Universal Broadband Infrastructure Would Return $43 million Annually to Counties Across Rural Black Belt

In partnership with the Southern Rural Black Women’s Initiative (SRBWI), today ILSR is releasing a new report that examines the link between high-speed Internet infrastructure, access to healthcare, and the economic implications involved.

The report – “Increased Wellness and Economic Return of Universal Broadband Infrastructure: A Telehealth Case Study of Ten Southern Rural Counties” – has particular relevance for those living in rural broadband deserts as it details how universal, affordable, broadband infrastructure would return $43 million per year using telehealth across 10 counties in the Black Belt of Alabama, Georgia, and Mississippi.

At a virtual press briefing today, SRBWI leaders and organizers were joined by Dr. Sandra B. Reed of Emory Healthcare; as well as ILSR Senior Researcher and the report’s lead author, Ry Marcattilio, to explain how robust broadband infrastructure could pay for itself in short order and open up untold access to healthcare, educational opportunities, economic development, community engagement, and other benefits along the way.

“It’s easy to miss the connection, but hard to overlook what’s at stake as rural hospitals close and the cost of transportation to get to far-off healthcare facilities presents a real barrier. This is about access to healthcare and Black women being denied the opportunity to take advantage of telehealth. The broadband infrastructure that’s needed for that just isn’t there,” said Shirley Sherrod, SRBWI State Lead for Georgia and Director of the Southwest Georgia Project in Albany Georgia.

Broadband … to Access Longer, Healthier Lives