After Years of Declining Service, Pikeville, Kentucky Strikes a Deal for a New Partnership

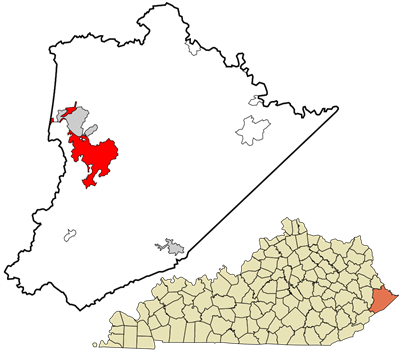

Pikeville, Kentucky (pop. 7,300) sits about 150 miles southeast of Lexington, in the extreme eastern part of the state. Today, after almost a decade of fighting with Internet Service Provider (ISP) Optimum about service so consistently poor that the city finally sued the provider, it’s working on an alternative: a partnership that will see the local government build new citywide fiber infrastructure and lease it to an operating partner.

A Tale As Old As Time

Publicly available data shows that, historically, about two-thirds of the city of Pikeville can take Internet service from Inter Mountain Cable - a regional provider with about 25,000 subscribers across Kentucky, West Virginia, and Virginia. Likewise, Optimum (formerly Suddenlink) offers cable service to about the same number of households. AT&T’s DSL service covers a little more than a quarter of town. Those living in the northern half of the city generally have better service options than those living in the southern half.

The path the city of Pikeville has taken began almost 15 years ago. In 2009, the local government signed a new, 10-year franchise agreement with Suddenlink. But when Altice (originally a French telecommunications company) bought Suddenlink back in 2015 to build its portfolio here in the United States, things quickly took a turn for the worse.